Brakke Viewpoints

We are the experts in animal healthBrakke Viewpoint September 19, 2025

Let’s talk about horses. The equine industry is the most fascinating segment in the animal health industry. In some ways it shares economic principals with the livestock industry. But it also demonstrates the deep passion and emotionalism of the pet industry. It is also the most complex segment of animal health with multiple unique product categories and brands. Success here requires marketers to be very well informed.

Earlier in this newsletter We announced the sixth edition of the Brakke Equine Market MegaStudy, this time in collaboration with Trone Market Research. This has become the go-to study of horse owner purchasing behavior, covering more than 15 product categories and more than 400 brands. There is also a wealth of data on horse owner demographics and media usage. I was the principal investigator for several of the equine studies. The project leader this year is my colleague Dr. Chuck Johnson who is actually an equine vet. I’m sure Dr. Johnson will bring many fresh insights to the study. If you are involved in or interested in the horse market, you’ll find this study to be a practical and productive resource.

John Volk, Senior Consultant

Chicago

Brakke Viewpoint September 12, 2025

Since I graduated as a veterinarian in 1989, the profession in Brazil has evolved to a completely different dynamic in veterinary care.

Veterinary medicine for companion animals in Brazil is now marked by autonomy and specialization. According to Radar Vet 2025*, 72% of veterinarians now work independently—a sharp rise from 26% in 2021—reflecting growing demand for personalized care. Only 14% have formal employment contracts, and clinic owners dropped from 33% to 14%, highlighting the sector’s decentralization.

Specialized training has become essential: 66% of professionals already hold or are pursuing postgraduate degrees, with growing interest in nutrition, acupuncture, and complementary therapies. The pet ecosystem has expanded to include daycare, physiotherapy, rehabilitation, personalized nutrition, and alternative treatments. On average, dogs are referred to seven specialists and cats to five, demonstrating a collaborative approach to care.

Digital tools are reshaping how veterinarians connect with pet owners: social media is now key for education, client loyalty, and building trust. Looking at reducing costs for care, house-call veterinarians are growing in numbers, raising a new challenge for the industry to reach and communicate with them.

I am sure many of our News & Notes readers could grow or expand their business in Brazil and throughout Latin America. Let us help you grow.

Mauri Moreira

*newsletter COMAC – SINDAN 2025.

Brakke Viewpoint September 5, 2025

It always seemed to me the week after Labor Day was more than the end of the summer here in the US. It was the time of the year when we had to get serious about forecasting full-year performance and start planning in earnest for the next year. I’ll bet some of you are working on your spreadsheets right now.

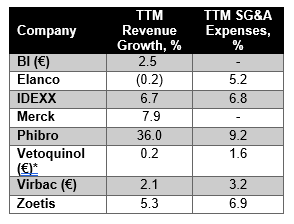

Let’s look at some publicly traded AH company performance metrics over the last 12 months (TTM) to help estimate what industry growth looks like this year and next. In this table are revenue growth rates and as an indicator of spending, SG&A expenses. These are as reported numbers, so the effects of exchange are not considered.

As our Industry Overview attendees know, we estimated currency corrected growth in 2024 at 6.7% and that the 10-year CAGR is 5.8%. If you consider the devaluation of the USD this year, which will likely cost about 2 points of total USD industry growth, it looks like another typical year in 2025 for industry revenue growth. Interestingly, where we have data, SG&A expense growth is higher than revenue growth in each company. Keep working on those spreadsheets.

Bob Jones

Brakke Viewpoint August 29, 2025

Emotional Intelligence: The Element AI Can Fake but Can’t Replace!

At the KC Animal Health Corridor’s AH Summit this week, we heard a lot about AI and there seems to be some AI fatigue setting in. Yes, AI is transforming business, offering powerful tools to analyze data, automate processes, and it will drive significant change across our industry. But when it comes to emotional intelligence, cultural sensitivity, and human connection, it still seems to fall short, especially in moments that demand deep empathy and nuanced judgment.

Take the example of a pet owner facing the painful decision to euthanize a beloved dog. AI might recognize this as a moment of grief, even generate comforting messages. But it can’t feel the complexity of guilt, shame, loyalty, relief and heartbreak that defines such a decision.

Similarly, in a global product launch, AI can suggest region-specific keywords or tailor messaging using sentiment analysis. But it won’t truly understand how a sales force in Japan may need more consensus-based tools, while teams in Brazil may thrive with spontaneous, relationship-driven pitches. A great person can navigate these differences, build trust across cultures, and adapt strategies in real time. That insight comes not from data, but from lived experience, empathy, and interpersonal skill.

The best business outcomes still rely on people who can connect with others in ways machines simply cannot. We have lots of data on the attributes veterinarian’s value in sales reps and we can’t help but say that it’s still all about people.

Empathy isn’t programmable … and that’s exactly what makes it powerful.

Alexis Nahama

Brakke Viewpoint August 22, 2025

For years, regulations have tethered vets to in-person exams before prescribing, limiting the reach of virtual care. Now, the telehealth landscape is shifting—creating new opportunities for practices, manufacturers, and investors.

Arizona, California, Idaho, District of Columbia, Florida, Idaho, New Jersey, Ohio, Virginia, and Vermont—currently allow vets to establish a VCPR (Veterinary-Client-Patient Relationship) via telemedicine. In 2024, Colorado advanced a ballot initiative, but it failed to qualify.

Additionally, Chewy, Mars Veterinary Health, and Amazon are actively lobbying for expanded telehealth, investing heavily in policy advocacy and digital infrastructure. Their message is simple: telehealth can expand access to care, reduce friction for pet owners, and strengthen client loyalty.

Key factors driving today’s telehealth push go beyond the obvious convenience and expanded reach to rural areas. Practices integrating virtual care report higher commitment to chronic disease monitoring, stronger engagement in preventive care, and improved compliance—particularly when pairing prescriptions with home delivery.

State regulatory differences and prescribing restrictions continue to pose short-term challenges, while many veterinarians are concerned about clinical standards and liability when practicing virtually. Pricing models are also evolving, raising questions about pet owner’s willingness to pay.

With telehealth shifting from a niche offering to an essential part of pet care, practices that embrace it —integrating it into practice workflows, client communication and product strategy—will be poised to capture growth and strengthen their role at the center of pet care.

The writing on the wall should be clear…telehealth is here to stay and it’s a game-changer.

Richard Hayworth

Brakke Viewpoint August 15, 2025

Recent headwinds—such as declining veterinary clinic visits, widespread cost cutting, and reduced commitments from private equity and venture capital firms—are creating challenges for the animal health industry. Although cost-cutting measures may be warranted, they can lead to turmoil and unrest both within organizations and throughout the broader sector. Private equity firms currently hold an estimated $2.5 trillion in uninvested capital, reflecting caution in the face of economic uncertainty.

Despite these challenges, our industry has a long history of stable growth and reliable returns. This track record raises an important question: Why wouldn’t investors want to be a part of such a resilient and essential field? As a community, we must ensure we are effectively communicating the value and potential of animal health, both within our organizations and to external investors. Having a well-thought-out, long-term strategy is essential, and companies should consistently advocate for the resources needed to maintain growth and innovation.

To support the sustainable health of our industry, we need ongoing investment—not just from animal health companies themselves, but also from outside investors. As leaders, we have a responsibility to do a better job of ‘selling’ our industry by highlighting its proven stability, profitability, and capacity for innovation. By focusing on these strengths and promoting a unified vision, we can attract sustained support, foster healthy growth, and ensure the vitality of animal health for years to come.

Paul Casady

Brakke Viewpoint August 8, 2025

Recent headwinds—such as declining veterinary clinic visits, widespread cost cutting, and reduced commitments from private equity and venture capital firms—are creating challenges for the animal health industry. Although cost-cutting measures may be warranted, they can lead to turmoil and unrest both within organizations and throughout the broader sector. Private equity firms currently hold an estimated $2.5 trillion in uninvested capital, reflecting caution in the face of economic uncertainty.

Despite these challenges, our industry has a long history of stable growth and reliable returns. This track record raises an important question: Why wouldn’t investors want to be a part of such a resilient and essential field? As a community, we must ensure we are effectively communicating the value and potential of animal health, both within our organizations and to external investors. Having a well-thought-out, long-term strategy is essential, and companies should consistently advocate for the resources needed to maintain growth and innovation.

To support the sustainable health of our industry, we need ongoing investment—not just from animal health companies themselves, but also from outside investors. As leaders, we have a responsibility to do a better job of ‘selling’ our industry by highlighting its proven stability, profitability, and capacity for innovation. By focusing on these strengths and promoting a unified vision, we can attract sustained support, foster healthy growth, and ensure the vitality of animal health for years to come.

Paul Casady

Brakke Viewpoint August 1, 2025

Recently, my colleague, John Volk wrote about the competitiveness within the pet food market, the largest segment of the pet market. I would like to expand on his comments.

We have all seen the humanization of our pets, which now includes the humanization of the food we give them. Fresh and frozen food represents one of the fastest growing pet food segments. Companies like Fresh Pet, Farmer’s Dog, Ollie, Nom Nom and Just Food for Dogs to name a few, are strong players in this market. The gloves are now off. Pet food behemoths including Mars’ Royal Canin and General Mills through its Blue Buffalo brand both have recently announced new fresh food products. In addition, back in February 2025, Hills announced the acquisition of Care TopCo Pty Ltd., an Australian company marketing the Prime100 brand of fresh pet food.

According to NIQ data, the fresh/frozen pet food segment grew +16.1% in dollars and +15.8% in unit sales in 2024. NIQ data shows that the fresh/frozen market is still small, representing just 3.6% of the total pet food market. While small, the growth rates are difficult to ignore, and the advertising and marketing expenditure reflects this. Not a day goes by without seeing a TV ad for the Farmer’s Dog brand, some of the best ads on TV.

The race is on to capture market share in the premium pet food segment. Who will be next to enter this market? More importantly, will anyone produce better ads than the Farmer’s Dog?

Randy Freides

Brakke Viewpoint July 25, 2025

According to some industry analysts, 60% of the animal health market’s value has been driven by innovation, which underscores the critical role of startups in maintaining the growth trajectory of the animal health industry. Recently, access to capital for animal health startups has tightened and to secure funding, startups must explore diverse sources, including angel investors, family offices, venture capital, private equity, and strategic partnerships.

I believe 2025 and 2026 present a prime window for investors, as evidenced by recent successful Series A and B rounds. Releveling valuations following 2024 market corrections further enhance investment appeal. For startups to attract this critical capital, they must demonstrate a deep understanding of the market, addressing:

- Market Potential: What is the realistic size and value of their target market?

- Distribution Strategy: How will they reach customers effectively?

- Competitive Landscape: Who are their competitors, and how do they differentiate?

- Value Proposition: What unique benefits do they offer?

- Financials: Are costs and selling prices well understood?

- Execution Plan: How will they achieve their ambitious goals?

By presenting a robust, data-driven business plan, startups can capitalize on the current market optimism and drive the next wave of animal health innovation. Which is why I am excited to attend the KC Animal Health Corridor’s 2025 Summit next month. Along with Alexis and the Brakke Consultants attending, we look forward to seeing the next wave of innovation.

Chuck Johnson

Brakke Viewpoint July 18, 2025

The largest pet product market is petfood, not animal health or veterinary services. The July issue of Petfood Industry magazine list 111 petfood companies globally, but 4 companies represent half or more of all petfood sales – Nestle Purina, Mars, Hill’s and General Mills. Nestle Purina and Mars, each with more than $22 billion in petfood sales, dwarf all other companies. (Hill’s, in third place, has sales of about $4.5 billion.) So petfood is even more concentrated than the animal health industry (pharmaceuticals, biologicals, diagnostics).

Interestingly, all of the large petfood companies are established consumer packaged goods companies. General Mills was the most recent major CPG entrant with its purchase of Blue Buffalo in 2018. Mars, one of the largest privately held companies, is also a major player in veterinary services and technology. All of the largest petfood companies market therapeutic diets, and have large sales forces calling on veterinarians, many of which were highly rated in Brakke Consulting’s 2025 Sales Force Effectiveness Study.

It’s important to recognize that there’s an immense amount of competition for veterinarians’ time and attention from a variety of different suppliers. What are you doing to earn your share?

John Volk