***********************************

Brakke Consulting’s

Animal Health News & Notes for December 10, 2021

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Brakke Consulting News

2021 US Flea Control & Heartworm Markets report – now available

Earnings News

Chewy

Other News

ALR Technologies

AMO Partners

Audax Private Equity

Bridge Bank

Ceva

Chewy

Diamond Pet Foods

Fidu

GlobalOne Pet Products

Hill’s

Infinovo Medical

International Finance Corporation

J.M. Smucker

Livia Global

Main Street Capital

Mixlab

Nextmune

Pamlico Capital

Penn Veterinary Supply

Pharmgate

PlantForm Corporation

POSCO International

Scout Bio

Thurston Group

Trupanion

Valley Vet Supply

Veterinary Practice Partners

Virbac

Vimian Group

VitusVet

Zenex Animal Health India

Zoetis

************************************

Brakke Consulting

2021 US FLEA CONTROL AND HEARTWORM MARKETS REPORT

NOW AVAILABLE

Are you on top of the trends in the largest market segment in companion animal health? Brakke Consulting has just published our 2021 report on the US Flea Control and Heartworm Markets.

The report includes valuable information on the US market for small animal parasiticides including:

– Product descriptions, prices (veterinarian cost and online pricing), and current and historical sales for the leading veterinary flea, tick and heartworm products

– an overview of the veterinary and OTC flea control markets

– discussion of new product launches, including CREDELIO CAT, FRONTLINE SHIELD, and IMOXI

– 2021 survey of 400 veterinarians

– 2021 survey of 500 pet owners

The report on the US Flea Control & Heartworm Markets is available for a purchase price of $7,995. Please contact Dr. Lynn Fondon at 336-396-3916 or lfondon@brakkeconsulting.com to order the report, or for more information visit our website.

************************************

COMPANY EARNINGS RELEASES

- Chewy, Inc. announced financial results for the third quarter of fiscal year 2021 ended October 31, 2021. Net sales were $2.21 billion, an increase of 24% percent year over year. Net loss was $(32.2) million, a 2% improvement over the prior-year period. Adjusted EBITDA was $6.0 million, an increase of 10% year over year. (company press release)

************************************

COMPANY NEWS RELEASES

- Zoetis announced that its Board of Directors has approved a $3.5 billion share repurchase program as part of its capital allocation plans. The shares are expected to be repurchased over a multi-year period. (company press release)

- Virbac announced the launch of its first product in the US food production animal market – Tulissin (tulathromycin injectable) Injectable Solution for use in cattle and swine. Virbac will market the cattle products with its own direct sales force; for swine, Virbac has entered into an agreement with Pharmgate to represent Virbac to swine veterinarians and producers across the US. (PRnewswire)

- Ceva Sante Animale announced a partnership with the Liryc institute (University Hospital Institute), a global institute in heart rhythm disorders. Ceva and Liryc share a common desire to create synergies in the search for innovative medical solutions in cardiology for both human and animal health, as part of a broader One Health approach. The fundraising agreement will make Ceva one of the five largest donors to the Liryc IHU. (company press release)

- Fidu and Hill’s Pet Nutrition have joined forces to offer clinicians free access to one-on-one nutrition consultations with board-certified veterinary nutritionists via Fidu’s virtual veterinary care platform. The nutrition consultations, which can normally cost upwards of $200, are free for a limited time to specialist and general practice veterinary professionals. (DVM360.com)

- The M. Smucker Co. announced it has sold its private label dry pet food business, including a manufacturing facility in Kansas, to Diamond Pet Foods in a cash transaction valued at approximately $33 million. The transaction does not include any branded products or the company’s private label wet pet food business. The divested business generated net sales of approximately $95 million for the fiscal year ended April 30, 2021. (Pet Product News)

- Chewy, Inc. and Trupanion, Inc. announced a partnership to offer an exclusive suite of pet health insurance and wellness plans to more than 20 million Chewy customers. Chewy will offer customers both preventative care wellness plans and comprehensive insurance plans for accidents, illnesses and chronic conditions. (company press release)

- Penn Veterinary Supply and VitusVet announced their partnership to provide veterinary hospitals with VetShipRx, a platform that empowers veterinary practices to offer same-day delivery of items off their shelves to their clients’ homes. (PRweb.com)

- Main Street Capital Corporation announced that it has completed a new portfolio investment to facilitate the recapitalization of Valley Veterinary Clinic, LLC d/b/a Valley Vet Supply. Main Street, along with several co-investors, partnered with the Company’s existing owners and management team to facilitate the transaction, with Main Street funding $42.2 million in a combination of first lien, senior secured term debt and a direct equity investment. (inforney.com)

- Canadian biopharmaceutical company PlantForm Corporation and POSCO International, South Korea’s largest trading company, have signed a Commercialization Agreement to bring HERBAVAC, the world’s first plant-based vaccine for Classical Swine Fever (CSF), to global markets. Under terms of the 10-year agreement, PlantForm will have exclusive rights to import, market, sell and distribute HERBAVAC in Canada, the US, Mexico, Brazil and Argentina. PlantForm will begin the registration process in the US and Canada, followed by the other territories. (Newswire.ca)

- Vimian Group announced it has purchased GlobalOne Pet Products, a supplier of premium treats and chews in North America, for $50 million. Vimian could pay an additional $30 million over three years from 2022 due to milestones stipulated as part of the transaction. The newly acquired firm will become part of Vimian’s Nextmune specialty pharma business. GlobalOne has annual revenues of around $20 million and an EBITDA of approximately $5 million. (IHS Markit Connect)

- Livia Global announced a recall BioLifePet and LiviaOne liquid probiotic supplements for cats and dogs due to possible contamination with Pseudomonas aeruginosa. Exposure to the bacterium can cause life-threatening infections in people, according to the CDC, though Livia says no adverse events related to the recalled products have been reported. (AVMA SmartBrief – Slashgear)

- Scout Bio announced the expansion of their foundational collaboration agreement with the Gene Therapy Program (GTP) at the University of Pennsylvania (Penn) to grant Scout Bio exclusive rights in the field of animal health to an emerging viral vector capsid technology for use in animal gene therapy, as well as extended option terms to other next-generation AAV vector technologies. Scout Bio currently has three AAV product candidates in clinical development. (Globenewswire)

- Mixlab – a compounding pharmacy with a prescription management platform – announced it has secured $6 million funding from Bridge Bank. The business will use the new investment to enhance its technology offering, scale sales and marketing efforts and expand to provide same-day delivery across new geographies. (IHS Markit Connect)

- Audax Private Equity (Audax) has made a strategic growth investment in Veterinary Practice Partners (VPP), a veterinary practice management group and portfolio company of Pamlico Capital. Terms of the transaction were not disclosed. (Private Equity Wire)

- Thurston Group, a private equity firm focused on investments in healthcare service companies, announced it has formed a Real Estate Investment Trust (“REIT”) dedicated to serving veterinary property owners, National Veterinary REIT. Thurston is partnering with experienced real estate investors, AMO Partners, to bring its REIT strategy to the veterinary sector. (newsbug.info)

- INDIA The International Finance Corporation (IFC) – part of World Bank – has proposed a $52.5 million investment in Zenex Animal Health India, composed of $16 million worth of equity shares for IFC and $36.5 million worth of shares for IFC’s Emerging Asia Fund (EAF). Zenex is a special purpose entity that acquired Indian group Cadila Healthcare’s animal health business earlier in 2021. IFC will acquire a stake in Zenex from the firm’s operating consortium – Multiples Private Equity Fund III. (IHS Markit Connect)

- SINGAPORE ALR Technologies announced the signing of a Memorandum of Understanding with Infinovo Medical Ltd for a global supply agreement of their P3 Continuous Glucose Monitor (CGM) for use by ALRT in the animal health sector. The Company expects to begin testing the GluCurve Pet CGM in veterinary clinics in the next few weeks, and complete it by the end of February 2022. (Yahoo.com)

***********************************

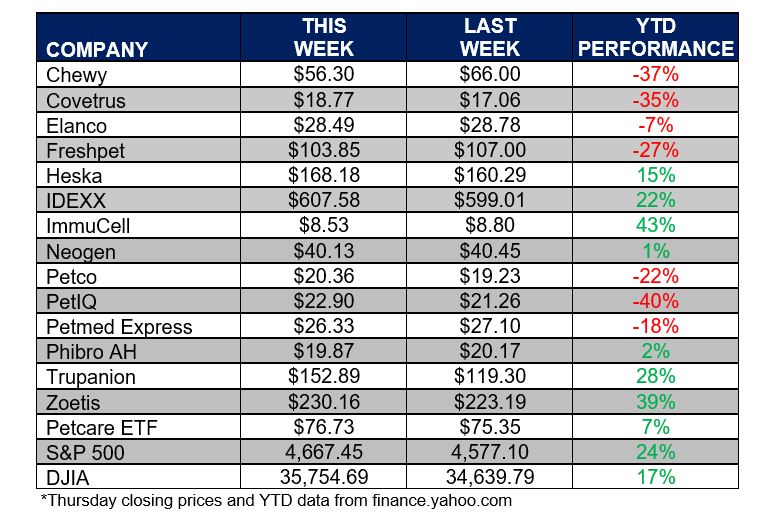

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – MUMS GRANTS – The FDA has opened a new period for applications for grants to support the development and approval or conditional approval of new animal drugs intended to treat uncommon diseases (minor uses) in major species (horses, dogs, cats, cattle, pigs, turkeys and chickens) or to treat minor species (MUMS). The maximum individual award amount is $250,000 per year per awardee, for up to two years for routine studies ($500,000 total) and up to three years for toxicology studies ($750,000 total). Only animal drug sponsors with Designated MUMS animal drugs or their research partners are eligible to apply. Click here for more information (FDA)

- US – ANIMAL WELFARE USDA’s Animal and Plant Health Inspection Service announced a final rule that requires regulated facilities to proactively develop contingency plans to safeguard their animals. (USDA)

************************************

BRAKKE CONSULTING VIEWPOINT

We are hearing a lot about how hard it is to find workers in our industry. Seems like the Law of Supply and Demand is at work.

The Bureau of Labor Statistics (BLS) reported that last week, initial jobless claims – a proxy for layoffs – fell to 184,000 in the week ended December 4, which is the lowest level since September of 1969. Hourly private sector wages were up 4.8% in November from the previous year, reflecting strong consumer demand and a tight labor market. Indeed, the supply of labor is down: the civilian labor force is smaller by 2.4 million people, or 1.4%, compared to 4Q2019. So, the Law of Supply and Demand still works.

It is easy to get lost in mountains of BLS data – but here is a number that struck me: Nonfarm business sector labor productivity fell 5.2% in the 3Q of this year (output declined 1.8%, hours worked increased 7.4%), which is the largest quarterly decline in since the 2Q of 1960.

All these numbers portend a real challenge for big and small businesses in 2022 to increase profits faster than revenue – how to manage rising labor costs, a shortage of workers, and slipping productivity. We expect big increases in labor costs in 2022 along with product price increases, which will propel inflation. More on what this means next week.

Bob Jones

***********************************

YOUR VIEW

Last week we asked if you thought there will be a mega-merger in animal health in 2022 and a majority (56%) said no. A few respondents left responses with their merger candidates, but we’ll keep them under wraps – don’t want to start rumors!

This week

This week let’s see what you think about productivity and working from home. Can’t wait to see your responses.