***********************************

Brakke Consulting’s

Animal Health News & Notes for October 7, 2022

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Brakke Consulting

Animal Health Jobs

Earnings News

CVS Group

Other News

Admiral

Biogénesis Bagó

Boehringer Ingelheim

Boulder Botanical & Bioscience Laboratories

Burns Pet Nutrition

Cowtribe

Embark Veterinary

Frankens Investment Fund

iYOTAH

Jurox

Kane Biotech

Laboratorio Mayors

LifeLearn Animal Health

Mars Veterinary Health

Merck

Midmark

MWI

Neogen

PetVivo

Phibro Animal Health

Real Brands

Shepherd Veterinary Software

SignalPET

Smart Paws

Trupanion (Smart Paws)

Trupanion (CKC)

Vet Candy

zant.

Zinpro

Zoetis (Jurox)

Zoetis (Valcor)

***************************************

EARNINGS NEWS RELEASES

- CVS Group reported results for the fiscal year ended 30 June 2022. Revenue increased 8.6% to GBP 554.2 million ($622 million). Operating profit was GBP 42.8 million ($48 million). (GlobalPets)

*********************************************

ANIMAL HEALTH JOBS

How difficult is it for your company to find the talent that you need? Chances are, it has become more difficult. It’s challenging for HR and talent leaders.

Animal Health Jobs wants to hear your thoughts on the hiring market. We’re conducting a survey to gain a deeper understanding on hiring in the Animal Health Industry. We will share these animal health and nutrition industry specific results with you in future blogs and white papers at Animal Health Jobs.

Once you complete the survey, you will be entered into a drawing for one of twenty- $10 Starbucks e-gift cards. Don’t miss the last chance to participate, the survey will close Monday, October 10th at 12:00!

CLICK HERE to take the survey!

*********************************************

COMPANY NEWS RELEASES

- Zoetis announced it has completed the acquisition of Jurox. Financial terms were not disclosed. (company press release)

- The FDA announced it has approved Zoetis‘ Valcor (doramectin and levamisole injection) for use in beef cattle two months of age and older and in replacement dairy heifers less than 20 months of age, Valcor is indicated for the treatment and control of gastrointestinal roundworms; lungworms; eyeworms; grubs; sucking lice; and mange mites. (FDA)

- Merck Animal Health announced the opening of a manufacturing facility for Merck Animal Health’s animal intelligence products in Baton Rouge, Louisiana. The facility will broaden the company’s manufacturing capacity and capabilities by establishing a printing, production and distribution facility of Allflex Livestock Intelligence identification ear tags. (company press release)

- The FDA announced it has approved Phibro Animal Health‘s Stafac and Monteban (virginiamycin and narasin Type A medicated article) and Stafac and Maxiban (narasin and nicarbazin Type A medicated article) for prevention of necrotic enteritis and coccidiosis in broiler chickens. (FDA)

- Neogen Corporation announced the launch of Encompass, a new platform for bovine genomic results management and visualization that will allow Igenity customers to gain greater insight into their data. Encompass is part of a larger data environment for producers from iYOTAH‘s nTELL platform. (Feedstuffs – subscription)

- Mars Veterinary Health announced the formation of an industry-wide working group aimed at strengthening the relationship between veterinary teams and pet owners through resources, education, and collaboration. (company press release)

- Zinpro Corporation announced the launch of Zinpro IsoFerm, an essential nutrient that fuels rumen function by directly feeding the fiber-digesting microbes. (Feedstuffs – subscription)

- SignalPET announced a partnership with Midmark Animal Health to expand the SignalSMILE dental radiology interpretation technology in the North American market. During the partnership, Midmark will offer a bundled offering for radiographic equipment and radiograph interpretation technology. (einnews.com)

- PetVivo Holdings, Inc. and MWI Animal Health announced an exclusive distribution agreement in which MWI will inventory, market, and promote PetVivo’s signature product Spryng with OsteoCushion Technology throughout the US. (Marketscreener)

- Embark Veterinary, Inc., announced the launch of its Age Test, a first-of-its-kind product in the dog DNA industry that uses a unique Embark-designed algorithm to measure a dog’s age from a saliva sample. (PRnewswire)

- Kane Biotech announced that it has received an additional $425,000 of funding for its DispersinB Hydrogel related to its Medical Technology Enterprise Consortium Research Project Award which was granted in 2020 and funded by the U.S. Department of Defense. (company press release)

- Real Brands announced an agreement to acquire Boulder Botanical & Bioscience Laboratories Inc., a manufacturer of supplements and CBD products, from Frankens Investment Fund. The acquisition is valued at $12 million, including a $1 million operating capital commitment. Boulder Botanical will retain its name and will operate as a new division of Real Brands. (Petfoodprocessing – subscription)

- LifeLearn Animal Health announced that ClientEd, the client education resource designed to save veterinary practices time and increase pet owner compliance, is now fully integrated into Shepherd Veterinary Software’s veterinary practice management software. (company press release)

- Vet Candy and , mental health services app, have partnered to bring much-needed tools and support to the veterinary profession – both students and professionals – and to normalize the mental health conversation. zant. is growing the largest network of underrepresented mental health providers with services ranging from anxiety, burnout, addiction recovery, eating disorders, depression, and more, in an effort to connect them with those in need across the U.S., especially college and university students. (company press release)

- ARGENTINA Biogénesis Bagó announced it has acquired fellow Argentine company Laboratorio Mayors, providing Biogénesis Bagó with a much broader portfolio of pet care products. Financial terms were not disclosed. (IHS Markit Connect – subscription)

- GHANA Boehringer Ingelheim announced that Cowtribe is the first recipient of investment and non-financial support from the Boehringer Ingelheim Social Engagement (BI SE) initiative, a program which aims to close a critical financing gap for social businesses in vulnerable communities. Cowtribe, a leading last-mile veterinary delivery company from Ghana, leverages technology to help coordinate deliveries of veterinary vaccines and other animal health products to rural and underserved communities. (company press release)

- GERMANY Smart Paws GmbH, a pet insurance provider in Germany and Switzerland, announced its union with Trupanion. Financial terms were not disclosed. (Streetinsider)

- CANADA Trupanion announced a partnership with the Canadian Kennel Club (CKC), providing immediate coverage for new litters without breed restrictions or exclusions. (company press release)

- UK Burns Pet Nutrition, a Welsh pet food company, announced it has partnered with financial services company Admiral to help launch Admiral Pet Insurance. As part of the collaboration, Admiral Pet Insurance will offer its customers discount codes on Burns’ pet food products. (Petfood Processing – subscription)

*********************************************

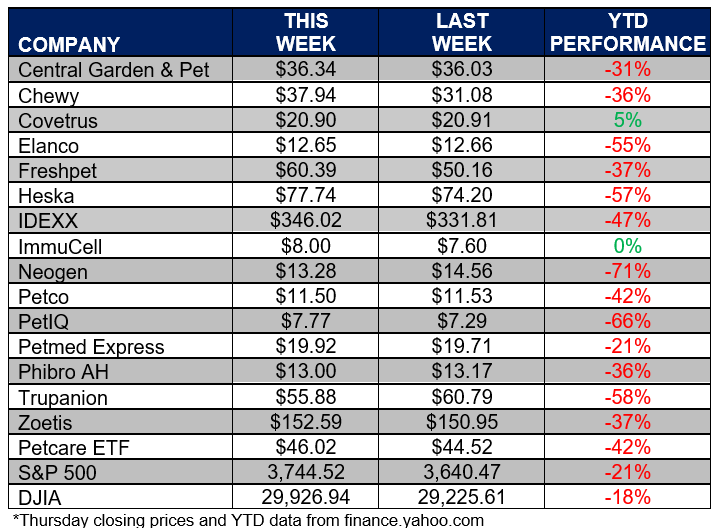

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – AVIAN INFLUENZA The USDA’s Agricultural Research Service (ARS) announced it has launched a research facility in Georgia to expand capacity of its Southeast Poultry Research Laboratory. The new facility will play a key role in expanding the ARS poultry research lab’s response to highly pathogenic avian influenza (HPAI) outbreaks in the region. (IHS Markit Connect – subscription)

- US – PET PRODUCTS Amazon announced it is improving its home robot Astro with a pet detection feature that will snap video clips so owners can see what their dogs and cats are doing and opt to receive live views or photos. The robot’s artificial intelligence is getting smarter as well, so the tech will be able to learn about objects in the owners’ homes like pet food bowls. (Pet Products SmartBrief – Digital Trends)

************************************

BRAKKE CONSULTING VIEWPOINT

Brakke Consulting started using Zoom before it became cool, or at least before its use exploded by the pandemic-driven closure of offices. Our business needed a “virtual” telephone system that our previous telecommunications provider couldn’t offer and we chose Zoom, which for our business model has been very good.

So, I was interested in what Eric Yuan said yesterday about the future of hybrid work at a BoxWorks 2002 virtual panel discussion. He said that the hybrid work model is “not that straight forward” and that his video communications company is “still trying to figure out what’s a sustainable business model for us.” This strikes me as odd, that the company that facilitated hybrid work doesn’t have their own hybrid model figured out.

We asked several questions of our readership last year about hybrid work and thought it would be interesting to look back on what we can learn. When asked one year ago about working conditions in the next 12 to 18 months, over 50% said their companies will implement a hybrid style with both remote and in-person work. We asked about productivity last December, over 60% said they were significantly more or more productive.

Now that we are in the middle of budget season, many companies, like Zoom, are trying to figure out what that model will be for 2023. Cool or not, Zoom (and Teams) are here to stay. Let’s hope it truly does drive productivity.

Bob Jones

***********************************

YOUR VIEW

Last week we asked about your expectations for growth in your company this year. About 20% of respondents said over 10% and about 20% said between 5 and 10%, but almost 40% said between 1 to 5% growth over last year. The remaining 20% said they would experience negative growth. We thought budgets for 2022 would be difficult, but our feeling is that budgets for 2023 will be even harder.