***********************************

Brakke Consulting’s

Animal Health News & Notes for March 24, 2023

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Brakke Consulting News

2023 Pain Management Products report – early-order ends March 31

Earnings News

Chewy

General Mills

Petco

Other News

Advantage+

Athian

Bundle x Joy

DVMAX

EarthWise Pet

Elanco

Equine Amnio Solutions

Felix&Fido

Freshpet

GOOD Meat

High Alpha Innovation

Innocan Pharma

Leap Venture Studio

Loyal Biscuit

Mars

MWI

Nexus Veterinary CE

Patterson

Petco

Pioneer Square Labs

R/GA Ventures

StringSoft

Tyree & D’Angelo Partners

V-Tech Platinum

Virbac

Vivesto

Volac

Weave

Western Veterinary Partners

***************************************

KC Animal Health Corridor

ANIMAL HEALTH SUMMIT

NOW ACCEPTING 2023 EMERGING COMPANY APPLICATIONS

APPLICATION DEADLINE IS APRIL 3

The KC Animal Health Corridor is now accepting applications from early-stage companies to present at the 15th annual Animal Health Summit, held in Kansas City on August 28-29, 2023.

The 15th annual Summit is one of the only opportunities in the world for early-stage companies in the animal health and nutrition sectors to present their vision, business plan and technology to potential investors.

The selection committee will consider companies that meet the following criteria:

- Seeking $500,000 – $20 million in funding, or strategic partnerships to advance a company’s technology

- Revenue projections of $20 million within 5-7 years

Applications are due by April 3. To apply to present as an emerging company, visit the Animal Health Summit application page .

For more information, contact Kimberly Young at young@thinkkc.com

**************************************

EARNINGS NEWS RELEASES

- Petco Health and Wellness Company, Inc. announced its full year 2022 financial results. Net revenue was $6.04 billion, up 4% versus prior year. Net income was $90.8 million, compared to $164.4 million in the prior year. (company press release)

- Chewy, Inc. announced financial results for the fiscal full year 2022 ended January 29, 2023. Net sales were $10.1 billion, a 13.6% year-over-year increase. Net income was $49.2 million, compared to a net loss of $(73.8) million in the prior year. (company press release)

- General Mills, Inc. reported results for its fiscal 2023 third quarter. Net sales for the Pet segment increased 14% to $646 million. Segment operating profit of $103 million was down 7%. (Seekingalpha)

*********************************************

BRAKKE CONSULTING

2023 PAIN MANAGEMENT PRODUCTS FOR DOGS AND CATS

LAST WEEK FOR EARLY ORDER DISCOUNT

Pain management is one of the leading topics in veterinary medicine today, and new, innovative products are changing the pain management paradigm. Is your company up-to-date on the latest trends in this important category?

Brakke Consulting’s annual report on Pain Management Products for Dogs and Cats includes such valuable information as:

– estimates of US sales and prices of leading products

– review of new and upcoming pain management products, including ZORBIUM and monoclonal antibody products SOLENSIA and LIBRELA

– discussion of the use of cannabinoids in veterinary pain management

– 2023 survey of 350 small animal veterinarians regarding use of pain management products

– Trended, aggregated practice-level data, powered by Vetsource, including chronic vs. acute use of analgesics, comparisons of analgesic revenue per patient by brand, and data on brand-switching at the patient level.

Pain Management Products for Dogs and Cats 2023 can be purchased for $8,450 if ordered by March 31, 2023, and $8,995 thereafter. The report will be completed in April. Questions about the study can be answered by project manager Lynn Fondon, DVM, MBA at info@brakkeconsulting.com.

*********************************************

COMPANY NEWS RELEASES

- Ag-tech startup Athian, which was launched just over a year ago by Elanco Animal Health and High Alpha Innovation, announced it expects to close a $5 million round of seed funding by the end of the month. Athian also expects this month to begin beta testing its first software product, a platform to help dairy farmers measure, verify and monetize their carbon-reduction efforts. (IBJ.com)

- Freshpet and Petco Health and Wellness Company, Inc. announced a partnership to produce and deliver fresh, customized subscription meal plans directly to pet parents’ doors. Freshpet Custom Meals will be available exclusively on petco.com. (company press release)

- Equine Amnio Solutions, LLC, distributor of the RenoVō equine allograft, announced that Patterson Veterinary Supply and MWI Animal Health have joined Covetrus as distributors of RenoVō in the US. (PRnewswire)

- Vivesto AB announced that the company has decided to initiate clinical development of the veterinary oncology drug candidate Paccal Vet (paclitaxel micellar) for treatment of hemangiosarcoma and malignant melanoma in dogs. (Marketscreener)

- EarthWise Pet announced they have acquired six Loyal Biscuit pet supply stores throughout Maine. Financial terms were not disclosed. (Pet Business)

- Pet food brand Bundle x Joy announced it has raised $1 million funding led by Leap Venture Studio, with participation from Mars Petcare and R/GA Ventures. (Globalpets)

- Weave announced four new integrations with DVMAX, V-Tech Platinum, Advantage+ and StringSoft practice management systems that serve veterinary practices, via a third-party partnership. Veterinary practice owners using these four practice management systems can now unlock integrated features of the Weave platform, including vaccination reminders, text writebacks and CallPop. (Businesswire)

- Innocan Pharma Corporation announced the launch of its licensing and commercialization strategy work with respect to cannabinoid (CBD) therapy in the veterinary field. The company’s goal is to commercialize, partner, and/or sell Innocan’s intellectual property portfolio to veterinary indications. (yahoo)

- Western Veterinary Partners announced it has received a strategic growth investment from a group of institutional limited partners, including both existing and new Tyree & D’Angelo Partners TDP will manage the new minority equity investment and will maintain its control equity position. (Businesswire)

- Felix&Fido, a spinout of Pioneer Square Labs (PSL), announced its entrance into the market with a $4 million pre-seed funding round. Led by PSL Ventures, the funding will be used to launch Felix&Fido’s premium, membership-based pet care plans, and deliver pet healthcare through in-clinic, at-home and telemedicine services. Felix&Fido currently offers in-home veterinary service via its mobile nurse unit and will open its first clinic in Washington this May. (PRnewswire)

- The FDA announced that it has completed its second pre-market consultation with a lab-grown meat company. GOOD Meat will use animal cell culture technology to take living cells from chickens and grow the cells in a lab to make cultured animal cell food. (Feedstuffs – subscription)

- Volac announced it has launched a new feed additives division that will provide a platform for new product development, which will focus on improving rumen microbial fermentation, efficient livestock production and reducing emissions. (Feed strategy)

- Nexus Veterinary CE announced the opening of two new CE Centers in Park City, UT and Baltimore, MD; each is located inside a multispecialty veterinary hospital. (company press release)

- FRANCE Virbac announced plans to ramp up its pet food production capacities by moving to a new factory in southern France. The company will invest EUR 40-50 million ($42-53 million) and launch the new plant at the end of 2025. (Petfood industry)

*********************************************

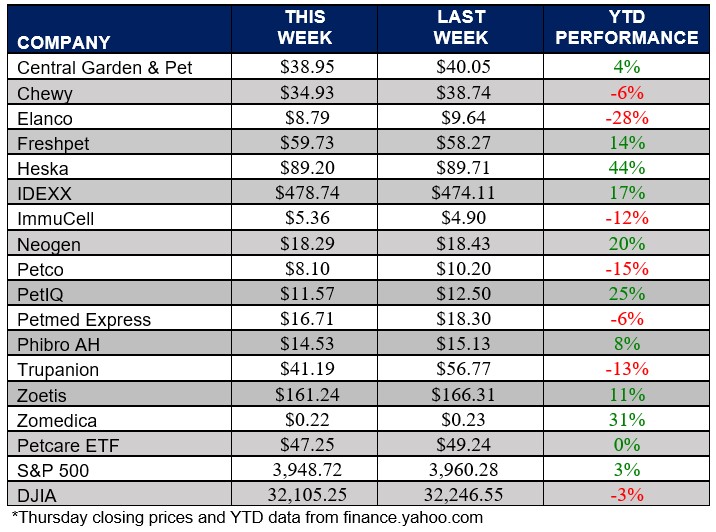

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- UK – BSE A single case of atypical Bovine Spongiform Encephalopathy (BSE) has been confirmed on a farm in Cornwall. The animal was routinely tested under the BSE fallen stock survey and was removed from the farm for disposal. (uk)

- US – DRUG ENFORCEMENT The U.S. Drug Enforcement Administration issued an alert about the widespread threat of fentanyl mixed with xylazine. DEA has seized xylazine and fentanyl mixtures in 48 of 50 states. The DEA Laboratory System is reporting that in 2022 approximately 23% of fentanyl powder and 7% of fentanyl pills seized by the DEA contained xylazine. The White House is looking at xylazine as a potential “emerging threat,” which would trigger the development of a federal plan to address it. In the meantime, the FDA has taken action to stop unlawful imports of xylazine. (CBS)

- US – COMPOUNDING The FDA announced that in April it will begin phasing in inspectional activities in relation to Guidance for Industry #256, Compounding Animal Drugs from Bulk Drug Substances. In this guidance, the FDA specifies the circumstances in which it plans to exercise enforcement discretion for relevant violations of the federal Food, Drug, and Cosmetic Act for drug approval, labeling and manufacturing. This means that although compounding from bulk substances for animal patients is still considered illegal, pharmacists and veterinarians may compound drugs in this way, without concern for enforcement action, provided they follow the guidance and adhere to certain criteria. (AVMA SmartBrief)

- US – ANIMAL HEALTH USDA’s Animal and Plant Health Inspection Service it is allocating $15.8 million to 60 projects aimed at combatting diseases that threaten livestock. The projects are spread across 38 states. Funding will come from the National Animal Disease Preparedness and Response Program that was included in the 2018 Farm Bill. (Farm Progress)

- US – VETERINARY SCHOOLS The Arkansas State University board of trustees approved a plan to create a college of veterinary medicine at its Jonesboro campus. The university aims to open the program, which would be the only one in the state, in the fall of 2025. (Vet Advantage)

- US – PET POISONS Recreational drugs for the first time have made the ASPCA Animal Poison Control Center’s annual list of top toxins for pets. These drugs, including marijuana-based substances, hallucinogenic mushrooms and cocaine, replaced gardening products in the No. 10 spot on the 2022 list. The APCC team last year fielded nearly 11% more calls related to potential marijuana ingestion than in the previous year, and they’ve seen a nearly 300% increase in calls over the past five years. (Vet Advantage)

************************************

BRAKKE CONSULTING VIEWPOINT

As my colleague Bob Jones shared recently, we attended the Kiasaco Animal Health conference recently in London. It was very well attended and kudos to organizing in conjunction with an executive meeting for Health For Animals, which as a result meant a lot of the company CEO’s were in attendance.

The program was very good, but there was some concern over the consolidation of these sort of events, and also the availability of general market information. Dominant companies may show predatory behavior in pricing, or simply cancelling out anyone they perceive as competition. For example, you can no longer subscribe to the old ‘Animal Pharm’ newsletter, if they deem you as competition. One of the only real global market surveys, CEESA, is only available to subscribers that have sales.

While this may have made some sense in the past when we were a ‘cottage industry’, today we have a >$40B industry with large, publicly traded companies. And we are attracting serious interest from private equity and other sources of funding which is critical for investing in innovation.

My view is that we need to make industry events and market information more available so that we continue to support the growing interest and investment in animal health. What is your company’s position?

Paul Casady

***********************************

YOUR VIEW

Last week we asked you about the change in energy supply infrastructure investment since 2014, according to the data from the International Energy Agency. From 2000 to 2014, it grew 7.7% but since then, it has actually declined 2.5% per year. Only 15% of our readers guessed right that it was less than zero. Over 25% of respondents thought the investment was over 10% and over 20% thought it was between 5 and 10%. There is a huge gap between what energy can be supplied and what the forecasted needs are, which leads to…ahem, lots of things. If you missed last week’s newsletter and the link to the McKinsey article this information was taken from, you can find it here.

This week

What are your thoughts on the availability of market data and industry events in animal health?