***********************************

Brakke Consulting’s

Animal Health News & Notes for July 2, 2021

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Other News

Adisseo

Aerapy Animal Health

Apiam Animal Health

Barentz International

Better Choice Company

Can-Fite BioPharma

Covetrus

Dairy Specialists

Gencove

Huvepharma

Lely North America

National Veterinary Associates

Native Microbials

Neogen

Pestell Nutrition

PetAirapy

Phoreus Biotech

PigCHAMP

Priority Robotics

Purina

QBiotics Group

SAGE Veterinary Centers

Swedencare AB

VCP

Vetbiolix

Vetio

Wind Point Partners

************************************

COMPANY NEWS RELEASES

- Huvepharma announced it has decided to put on hold its Amsterdam Euronext listing, after previously unveiling its plans to raise EUR 300 million ($355 million) through an initial public offering. Huvepharma said it would revisit the IPO project at a later date in the future, but for now it would remain private. (Reuters)

- Swedencare AB announced the acquisition of Vetio, an animal health contract development manufacturing organization (CDMO) in North America, for a purchase price of $181.5 million. The purchase price consists of $179 million cash and an issue in kind of 184,190 shares in Swedencare, representing $2.3 million to the selling management at closing. Vetio’s sales were $32.3 million for the full year 2020 with an adjusted EBITDA of $6.5 million. (company press release)

- Covetrus announced that it has entered into a definitive agreement to acquire VCP, a platform in veterinary wellness plan administration, serving approximately 1,000 veterinary practices. Financial terms of the transaction were not disclosed. (company press release)

- National Veterinary Associates (NVA) network announced it has acquired SAGE Veterinary Centers, an emergency and specialty group operating 16 practice in four states. SAGE Veterinary Centers will be positioned under NVA Compassion-First, the parent company’s 85-hospital specialty and emergency arm. Financial terms were not disclosed. (Todays Veterinary Business)

- Neogen and Gencove announced a multi-year agreement will allow Neogen to offer the latter’s SkimSeek sequencing technology to customers in the bovine, poultry, swine and canine industries. Neogen first entered into a collaboration with Gencove at the start of 2020. (IHS Markit Connect)

- Purina announced the launch of Calming Care, a Pro Plan Veterinary Supplement for cats. Also used in dogs, Calming Care contains Bifidobacterium longum (BL999), a probiotic strain shown to help both cats and dogs maintain calm behavior. (company press release)

- Better Choice Company announced the pricing of its underwritten public offering of 8,000,000 shares of its common stock at a public offering price of $5.00 per share providing gross proceeds of $40 million prior to deducting underwriting discounts, commissions and other estimated offering expenses. (Globenewswire)

- Native Microbials announced the launch of Arkus Daily, a canine probiotic supplement made with the microbes that are native to the gut of healthy dogs: Clostridium hiranonis; Megamonas funiformis; and Enterococcus faecium. (Valdostadailytimes.com)

- PetAirapy, a manufacturer of ultraviolet germicidal irradiation products for the animal care industry, announced its new branding as Aerapy Animal Health. (PRnewswire)

- Dairy Specialists LLC announced an agreement to acquire the assets of Priority Robotics, which specializes in the distribution, installation and service of robotic dairy milking equipment and holds an exclusive territory dealership for Oregon and Washington with Lely North America. Financial terms were not disclosed. (Feedstuffs)

- Phoreus Biotech announced it has a draft term sheet in place with a major animal health company for development of mRNA vaccines. The firm believes its peptide-based nanocarrier technology offers increased efficacy in the creation and delivery of veterinary vaccines, antibiotic alternatives and cancer therapeutics. (IHS Markit Connect)

- CANADA Barentz International announced an agreement to acquire Pestell Nutrition from Wind Point Partners. Pestell is a distributor of feed additives, nutritional ingredients, macro and trace minerals, and pet specialty ingredients in North America; sales in 2020 were approximately $237 million. Financial terms were not disclosed. (PEhub.com, FeedNavigator.com)

- EU Can-Fite BioPharma, a biotechnology company advancing a pipeline of proprietary small molecule drugs that address inflammatory, cancer and liver diseases, announced it has signed a development and commercialization agreement with France-based Vetbiolix for the development of Piclidenoson – a highly selective A3 adenosine receptor agonist – for the treatment of osteoarthritis in companion animals including dogs and cats. (Biospace.com)

- SPAIN Adisseo announced it has agreed to take a 24.99% stake through a capital increase in PigCHAMP, which is focused on information systems, farm equipment, software and services at every level of pig production. (IHS Markit Connect)

- AUSTRALIA QBiotics Group Limited announced that it has concluded an $85 million capital raise, which consisted of three parts: a A$50 million placement to cornerstone investor TDM Growth Partners; a A$22.55 million placement to Existing Sophisticated Investor; and a A$12.5 million placement to Existing Shareholders. (Finance.yahoo.com)

- AUSTRALIA Apiam Animal Health announced the introduction of Data Pig, a new proprietary electronic recording system for hog producers. The platform gives producers the ability to carry out improved disease surveillance in real time; it also automatically generates APIQ compliant digital records and allows users to more accurately monitor medication compliance and use. (Stockhead.au.com)

***********************************

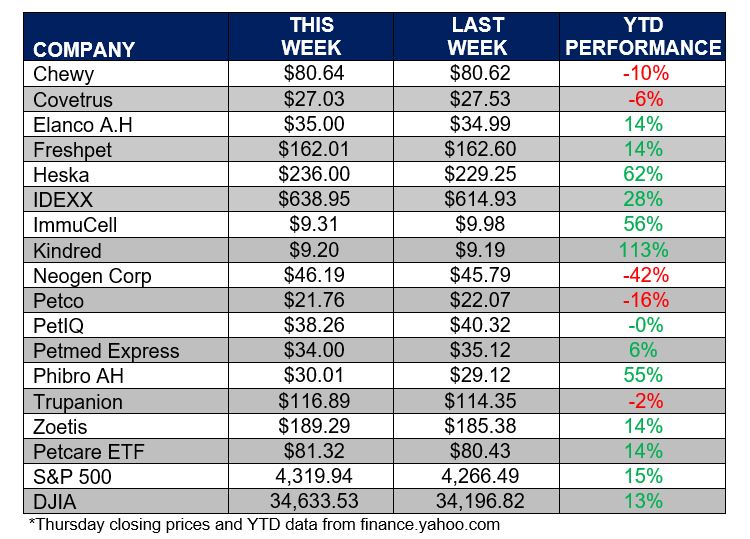

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – VETERINARY EDUCATION The Veterinary Medicine Loan Repayment Program Enhancement Act (VMLRPEA) has been reintroduced in the US Senate. Endorsed by the American Veterinary Medical Association, the bipartisan bill would enhance the Veterinary Medicine Loan Repayment Program by ending the federal withholding tax on awards, thus freeing up funding and allowing the program to reach more communities that need veterinary services. (PRnewswire)

- WORLD – ANTIBIOTIC USE A report published this spring by the World Organization for Animal Health (OIE) indicates the volumes of antimicrobials administered to food-producing animals, measured in milligrams per kilogram of body weight, declined one-third from 2015 to 2017, from 174 mg/kg to 115 mg/kg. There was substantial regional variation. (JAVMA)

- US – FELINE GUIDELINES The American Association of Feline Practitioners (AAFP) announced the release of the updated 2021 AAFP Feline Senior Care Guidelines, to be published in the July issue of the Journal of Feline Medicine and Surgery. (association press release)

************************************

BRAKKE CONSULTING VIEWPOINT

The majority of items in this week’s newsletter report on investments, IPOs, divestitures and acquisitions – signs of a healthy industry. The acquisition of VCP by Covetrus caught my eye. I’ve been an advocate of preventive care plans for many years because research shows that pet owners like them and pets get more and better veterinary care. With preventive care plans, a veterinary practice creates a bundle of annual preventive services – exams, vaccines, diagnostics, sometimes parasiticides – and pet owners pay for it in monthly installments. It’s the subscription model for veterinary care. For Covetrus, it’s one more expansion into non-distribution services, and no doubt fits well with its PIMS software portfolio. Who will be next to get into the preventive care plan business? Opportunity awaits.

John Volk

***********************************

YOUR VIEW

Last week we asked about use of fresh, refrigerated pet food. It turns out, 5% of newsletter readers feed it, 10% have tried but discontinued, and 85% have never tried it. I don’t know how that aligns with the overall market, but I’m guessing it’s not far off. Half of you expect the fresh pet food market to grow on pace with the overall industry, the other half are about equally split between faster and slower than the pet food market in general.

This week

We’re officially into summer, so this week our question is:

Will you take a vacation within the US this year? And will you take a pet with you?

Have a great 4th!