***********************************

Brakke Consulting’s

Animal Health News & Notes for January 28, 2022

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Brakke Consulting News

2022 Industry Overview

Earnings News

Fressnapf

PetMed Express

Vetoquinol

Other News

A&M Capital Partners

ArcaNatura SAS

Bactana Corp

BC Partners

Beijing Dabeinong Technology Group

Elanco

Fulcrum Equity Partners

Hagyard Equine Medical Institute

Hunan Jiuding Technology

Huvepharma

Innovet

Kitty Sift

KKR

Lowe’s

MentorVet

My Pet’s Vet Group

NaturVet

OMNI

Petco

PetSmart

Swedencare

The Vets

Vetoquinol

Worldwise

Ÿnsect

************************************

Brakke Consulting

Announcing the 2022 Brakke Industry Overview

Presented at WVC: Monday, March 7th, 2-4 pm, Four Seasons Hotel, Acacia Ballroom

We are back to being in person! Come join us at Brakke Consulting’s annual Industry Overview presented at VMX and WVC in 2022. The Overview will feature industry and top global company performance, brand new market research from companion animal veterinarians, and a closer look at the current and future use of monoclonal antibodies in veterinary medicine.

Brand new this year – led by Brakke Senior Consultant Paul Casady, a panel of industry leaders will discuss their views on the outlook for the companion animal market, so you can hear firsthand from these experts. Panelists for WVC will include:

– Mr. Randolph Legg, President and Head of Commercial Business, Boehringer Ingelheim Animal Health USA

– Mr. Steve Shell, President, MWI Animal Health

– Mr. Greg Hartmann, Chief Executive Officer and Board Director, NVA

Sign up today using this link, or email Amanda McDavid or call her at 336-396-3916. Pre-registration cost is $399; there are discounts for multiple attendees from the same company. We look forward to seeing you there!

www.BrakkeConsulting.com

*********************************************

EARNINGS NEWS RELEASES

- Vetoquinol reported results for the full year 2021. Sales were EUR 521 million ($591 million), up 22% as reported and up 22% at constant exchange rates. (finance.yahoo.com)

- PetMed Express, Inc. announced its financial results for the quarter ended December 31, 2021. Net sales were $61 million, a decrease of 8% compared to the prior-year quarter. Net income was $4.3 million, a 44% decrease year-over-year. (company press release)

- Fressnapf reported results for the full year 2021. Sales were EUR 3 billion ($3.4 billion), an increase of 20% year-over-year. (Globalpets)

************************************

COMPANY NEWS RELEASES

- The FDA announced it has approved Huvepharma‘s Tilmovet AC (generic tilmicosin phosphate) aqueous concentrate for oral use in drinking water for swine. (IHS Markit Connect)

- Vetoquinol USA announced the availability of the Phovia pet-specific dermatology fluorescent light therapy system. Phovia helps accelerate natural skin regeneration for most lesions. (company press release)

- According to a Bloomberg report, PetSmart – currently owned by BC Partners – is in early-stage discussions to go public through a special purpose acquisition company led by KKR. This transaction could reportedly value PetSmart at around $14 billion. (IHS Markit Connect)

- Lowe’s and Petco Health and Wellness Company, Inc. announced a pilot store-in-store program that brings products, services and expertise – for both home and pets – into one, convenient stop at select Lowe’s locations. The first Lowe’s + Petco store-in-store concept is expected to open at a Texas Lowe’s in early February, with plans to expand to 14 additional Lowe’s locations in Texas, North Carolina, and South Carolina by the end of March 2022. (Prnewswire)

- Swedencare announced two more acquisitions in the companion animal sector: NaturVet in the US and Innovet in Italy, giving the company around $75 million in extra annual revenues. NaturVet’s acquisition cost consists of $400 million in cash and an issue-in-kind of around 3.85 million shares in Swedencare, as well as $47.5 million when the deal closes and a condition-based earn-out of up to $27.5 million. Innovet’s deal consists of EUR 42.5 million ($48 million) in cash and an issue of 606,799 shares in Swedencare, as well as EUR 7.5 million upon closing of the transaction. (IHS Markit Connect)

- Hagyard Equine Medical Institute announced that they are now offering PCR testing for Rotavirus B. The Rotavirus PCR test is available as a single test or as part of Hagyard’s Neonatal Panel or Foal Diarrhea Panel. (company press release)

- A&M Capital Partners (AMCP) announced that Worldwise, an AMCP portfolio company, acquired Kitty Sift, an innovator in the highly consumable cat litter and accessories segment. Financial terms were not disclosed. (Pet Business)

- Fulcrum Equity Partners announced their investment in My Pet’s Vet Group, a veterinary medicine platform with hospitals in Ohio, Texas and Georgia. Financial terms were not disclosed. (PRweb)

- The Vets, a tech-enabled pet care platform providing premium at-home pet care and championing a healthy work environment for veterinarians, announced it has raised $40 million secured in seed funding. (PRnewswire)

- Ÿnsect, a leader in producing insect-based ingredients, announced the launch of ŸNFABRE, the first industrial genomic selection program applied to mass insect farming. (company press release)

- MentorVet, a program to help recent veterinary school graduates thrive within their field, announced it was selected as the winner of the fifth annual VMX Pet Pitch Competition. MentorVet provides resources to new veterinarians through a combination of peer group meetings, online learning modules and mental health coaching to promote wellbeing within the veterinary profession. (company press release)

- EU The Committee for Medicinal Products for Veterinary Use (CVMP) of the European Medicines Agency has recommended approval of a new indication for Elanco‘s Credelio for the treatment of demodicosis (caused by Demodex canis) in dogs. (IHS Markit Connect)

- UK OMNI, a vet-backed, plant-based dog food startup announced it has raised GBP 1.1 million ($1.2 million) from investors to aid in the company’s plans for expansion. The company, which offers 100% a plant-based, nutritionally complete food that is healthy for dogs, soft launched in the UK in May 2021. (Petfoodprocessing.net)

- CHINA Beijing Dabeinong Technology Group announced it will pay CNY1.32 billion ($208 million) for the acquisition of a 30% equity stake in Hunan Jiuding Technology, a manufacturer and supplier of feed additives for livestock. Dabeinong will pay 50% of the fee on the closing of the deal and the remainder in installments before January 31, 2023. Once these fees have been paid, Dabeinong will start acquiring the remaining 70% of the company for be CNY3.08 billion from 13 shareholders. The full transaction is expected to close in 2025. (IHS Markit Connect)

- FRANCE Bactana Corp announced that they have signed a distribution agreement with France-based ArcaNatura SAS to launch Bactana’s first commercial product, Pawsni Glucose Control for pets. FPZ-100, Bactana’s patent pending active ingredient in Pawsni Glucose Control, has been shown to significantly reduce diabetic and prediabetic blood markers without causing undesirable hypoglycemic side effects. (PRweb)

***********************************

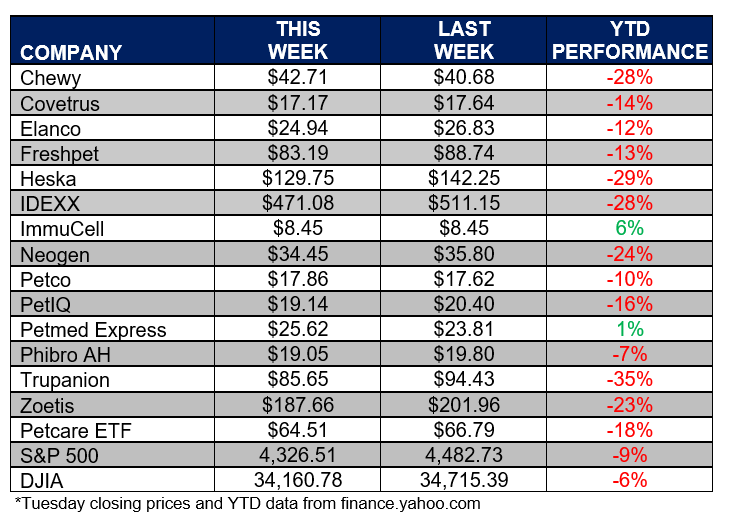

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – ANTIMICROBIAL STEWARDSHIP The FDA’s Center for Veterinary Medicine is announcing two Fiscal Year (FY) 2022 funding opportunities which could provide up to $800,000 in support of antimicrobial stewardship in veterinary settings and reducing antimicrobial resistance in animal agriculture. Click here for more information. (FDA)

************************************

BRAKKE CONSULTING VIEWPOINT

Towards the end of 2021, Bob Jones wrote about the US economic situation and the inflation the country is experiencing. As 2021 came to a close, the CPI posted an annual rate increase of +7%, the highest rate since 1982. While nominal wage gains were higher than seen in many years, when adjusted for inflation, real wages declined by -2.5%.

Recall that in the early 1980’s, the inflation rate (CPI) peaked at 14.8%. To tackle inflation, the Fed drove the country into a recession, increasing their benchmark interest rate as high as 19%. Two critical differences between the 70’s and today relate to the labor market. Back in the early 1980’s, unemployment peaked at almost 11% whereas today’s rate is 3.9%. However, today we are experiencing significant labor shortages partly driven by the labor participation rate (work rate for prime-age people; 25-54 yrs. old) that peaked at 67% in 2000 and is now about 62%.

The Animal Health industry is facing similar inflationary challenges. We heard from one senior executive at VMX that costs continue to rise due to supply chain disruptions, labor shortages and wage increases, especially for manufacturing talent. Companies are passing along the cost increases to customers to the extent they can, trying to maintain margins.

2021 was an extremely strong year for the Animal Health industry. 2022 may prove to be much more challenging forcing business leaders to navigate choppy waters driven by the multitude of headwinds facing global economies.

Randy Freides

***********************************

YOUR VIEW

VMX 2022 is a wrap. In-person attendance, while not as strong in the last non-pandemic year of 2020, was still good with 13,000 in-person participants. In last week’s question we asked those who attended VMX about your experience at the conference. 48% responded that your experience was better than expected, 30% said it was about what was expected and 22% said it was not as good as expected.

This week

For those of you who have openings in your business how long is it taking to fill those vacancies?