***********************************

Brakke Consulting’s

Animal Health News & Notes for August 13, 2021

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Earnings News

Cryoport

Elanco

Fressnapf Group

Kindred Biosciences

MWI

Original BARK Company

Ouro Fino Saúde Animal

Spectrum Brands

Zomedica

Other News

AKC Pet Insurance

Andritz

Animal Health & Nutrition Company

Aqua-Spark

Axiota Animal Health

BetterVet

Cama Group

Cargill

Chewy

Clevertech

Continental Grain Company

Covetrus

Dassiet

Elanco

Ellie Diagnostics

Galaxy Vets

Huon Aquaculture Group

Independence American Insurance Company

JBS

JBT FTNON

JRS

Karl Schnell

Miavit

Mid America Pet Food

Modern Animal

MS Biotec

MULTIMIN USA

Nature’s Logic

Nebula Caravel

Nutreco

OPEM

OrthoPets

The Packaging Group

PetPartners

PFR Life Science

Proteon Pharmaceuticals

PSIvet

ReadiVet

Rover

Sanderson Farms

VetBoost

Vetcove

Vet Inflow

VetsDigital

Waldner

Zoetis

************************************

2021 Digital Animal Health Summit

August 24-26, 2021

Location: Online

Registration is now open for the Digital Animal Health Summit.

Register today! The Digital Animal Health Summit features 27 hours of 1:1 business partnering, 8 LIVE programs, 10+ on-demand webinars and 10+ emerging company presentations. Learn more

************************************

COMPANY EARNINGS RELEASES

- Elanco Animal Health reported financial results for the second quarter of 2021. Revenue was $1.28 billion, an increase of 118%; legacy Elanco revenue increased 28% year over year. Products from the legacy Bayer Animal Health business contributed $529 million. Gross profit was $728 million compared with $290 million for the second quarter of 2020. Net loss was $(210) million, compared with net loss of $(53) million for the same period in 2020. (company press release)

- AmerisourceBergen reported results for its fiscal third quarter. MWI Animal Health’s revenues were up 18% to $1.19 billion. (IHS Markit Connect)

- Ouro Fino Saúde Animal reported results for the second quarter of 2021. Turnover was R$231 million ($44.2 million), a 34% improvement compared to the prior-year quarter. (IHS Markit Connect)

- Kindred Biosciences reported results for the second-quarter of 2021. Revenue was $3.5 million compared to revenue of $39.6 million in the prior-year quarter. Net loss was $(9.1) million, compared to net income of $24 million in the second quarter of 2020. (company website)

- Spectrum Brands Holdings reported results for its fiscal third quarter ended July 4, 2021. Global Pet Care sales were $257 million, an increase of 6.5% over the prior-year quarter due to acquisition sales; organic sales declined 7%. Adjusted EBITDA for the segment was $49 million, a decline of 3%. (company website)

- Zomedica reported consolidated financial results for the second quarter of Revenue was $15,693 and resulted from the sale of Truforma products and associated warranties, which commenced commercialization on March 15, 2021. Net loss was approximately $(4.7) million, compared to a net loss of approximately $(5.3) million in the prior-year quarter. Zomedica had cash and cash equivalents of approximately $276 million as of June 30, 2021, compared to approximately $29 million as of June 30, 2020. (Finance.yahoo.com)

- Fressnapf Group reported results for the first half of 2021. Gross sales were EUR 1.48 billion ($1.74 billion), an increase of 21%. (GlobalPets)

- The Original BARK Company announced financial results for its fiscal 2022 first quarter ended June 30, 2021. Revenue was $118 million, a 57% increase year-over-year. Quarterly subscription shipments increased 52% to 3.6 million, year-over-year. Net loss was $(24.8) million compared to net income of $2.0 million in the prior-year quarter. (Yahoo finance)

- Cryoport, announced financial results for the second quarter of 2021. Animal Health revenues were $8.4 million compared to $220,000 in the prior-year quarter, driven by the acquisition of MVE Biological Solutions. (Timesnews.net)

************************************

COMPANY NEWS RELEASES

- Elanco announced the launch of Credelio Cat (lotilaner), the first and only oral flea and tick product for cats. (company press release)

- Chewy has filed a lawsuit alleging that Vetcove enlisted Covetrus in a conspiracy to intentionally interfere with Chewy’s sales of medication and regulated pet products by diverting digital sales of pet prescriptions. Covetrus has filed a motion to dismiss the lawsuit, denying any close relationship with Vetcove and claiming that the lawsuit was only intended to boost Chewy’s own sales. (Law.com)

- Ellie Diagnostics and PSIvet have entered a partnership that will offer PSIvet member veterinarians access to Ellie Diagnostics’ network of animal reference laboratories. (IHS Markit Connect)

- Dassiet and OrthoPets announced a collaboration to create pet healthcare products. The first products are a new collaborative line of fracture and wound care products, called UPETS, which utilize Dassiet’s remoldable, non-toxic and light weight Woodcast material and a newly patented breathable, self-cohesive fabric. (PRnewswire)

- Mid America Pet Food, LLC announced it has acquired Nature’s Logic, a manufacturer of lightly cooked frozen recipe pet foods. Mid America Pet Food and Nature’s Logic will continue to operate as separate businesses. Financial terms were not disclosed. (Pet Business)

- Galaxy Vets, a veterinary healthcare system co-owned by employees, announced it is launching nationwide. Galaxy Vets will be acquiring general practices within a small region to then build a new surgical and emergency specialty hospital with its own reference laboratory, to create a vertically integrated veterinary healthcare system. Galaxy Vets is actively looking for partners and employees across the US. (Bluemountaineagle.com)

- Mobile veterinary startup BetterVet announced its latest launches into two new markets in Palm Beach, Florida, and Austin, Texas. Founded in July, 2020, BetterVet is currently available in the Greater Boston, Philadelphia, Pittsburgh, Denver, Austin, Palm Beach and Broward areas, and will be launching soon in more cities across the US. (elpasoinc.com)

- Modern Animal announced that it raised $75.5 million in funding, including a $35.5 million Series A led by True Ventures and Addition and a $40 million Series B led by Founders Fund. Based in Los Angeles, Modern Animal offers veterinary clinics, an easy-to-use app, and 24/7 virtual care. (Pulse2.com)

- ReadiVet, a provider of on-demand, at-home veterinary care for pets and their parents, raised $2.5 million in Series A funding. The round was led by Atlanta Seed Company. The company has two locations in Dallas, Texas, and plans to open four clinics in the next 12 months. (Finsmes.com)

- PetPartners announced it is now offering pet insurance customers coverage for pre-existing conditions across all of its accident and illness plans. The company will offer this service through its AKC Pet Insurance and PetPartners brands. Independence American Insurance Company is serving as underwriter for this coverage. PetPartners is also introducing Breeding Coverage for both male and female dogs – an optional add-on benefit that helps pay for unforeseen accidents, illnesses or complications related to breeding, pregnancy, whelping or nursing. (IHS Markit Connect)

- Rover, an online marketplace for pet-care services, began trading under the ticker “ROVR” after completing a merger last week with shell company Nebula Caravel. The listing raised $270 million in additional cash for the company. (Pet Products Smartbrief)

- Cargill, Continental Grain Company, and Sanderson Farms, Inc. announced they have reached a definitive agreement for a joint venture between Cargill and Continental Grain to acquire Sanderson Farms for $203 per share in cash, representing a total equity value for Sanderson Farms of $4.53 billion. Upon completion of the transaction, Cargill and Continental Grain will combine Sanderson Farms with Wayne Farms, a subsidiary of Continental Grain, to form a new, privately held poultry business. Upon the completion of the transaction, Sanderson Farms will become a private company, and its shares will no longer be traded on NASDAQ. (Feedstuffs)

- Ten companies have joined forces as the Pet Food Competence Network, teaming up to become a single source for end-to-end wet and dry pet food plant solutions. The Network comprises Miavit, JRS, JBT FTNON, Andritz, Waldner, Cama Group, OPEM, The Packaging Group, Clevertech, and Karl Schnell. (GlobalPets)

- Animal Health & Nutrition Company, a Paine Schwartz Partners portfolio company, announced that it has rebranded as Axiota Animal Health. Formed in 2019 as an animal health and nutrition platform, Axiota serves the cattle industry through its operating companies, Multimin USA and MS Biotec. (Feedstuffs)

- CANADA Zoetis announced it has received Canadian authorization for Solensia (frunevetmab) once-monthly injectable monoclonal antibody for alleviating of pain associated with osteoarthritis in cats. (IHS Markit Connect)

- AUSTRALIA JBS

announced that it is officially entering the aquaculture sector through its acquisition of Huon Aquaculture Group Limited for AU$3.85 per share, representing an implied equity value of AU$425 million ($314 million). Huon is Australia’s second largest salmon aquaculture company with vertically integrated operations situated in Tasmania. (Feedstuffs) - POLAND Proteon Pharmaceuticals announced it has received EUR 21 million ($24.6 million) in funding led by Nutreco, Aqua-Spark and PFR Life Science. The firm develops bacteriophage technologies that are designed to modulate the microbiome of food-producing animals and enable prophylactic health, as well as reducing the need for antibiotic use. (IHS Markit Connect)

- UK Veterinary digital marketing agency VetsDigital announced it is merging with two veterinary marketing companies, Vet Inflow and VetBoost. The three companies will combine under the VetsDigital brand. Financial terms were not disclosed. (Vettimes.co.uk)

***********************************

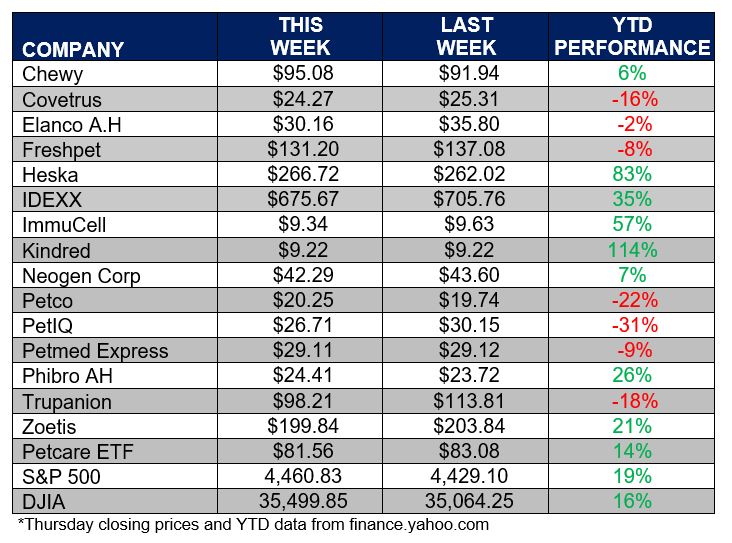

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – ASF REGULATIONS USDA’s Animal and Plant Health Inspection Service (APHIS) is issuing a Federal Order establishing additional requirements that take effect August 16, 2021 for dogs imported into the US from countries where African swine fever (ASF) exists. The number of dogs being imported for resale from ASF-affected countries is growing, and APHIS is taking this action to continue its efforts to protect the United States’ swine industry against this devastating disease. Click here for details. (USDA)

- US – PET FOOD REGULATION The FDA’s Center for Veterinary Medicine (CVM) will host a virtual listening session Friday, September 24, 2021 from 1:00 p.m. until 4:30 p.m. ET on the FDA’s oversight of pet food. For additional information about the listening session, including instructions for those interested in attending or presenting, click here. (FDA)

- WORLD – ZOONOSES The World Small Animal Veterinary Association’s One Health Committee announced it is working on plans to build a smart phone app for use by physicians and veterinarians, giving them relevant information about the most common zoonotic agents at their fingertips. This program will be developed in parallel with the Zoonoses Guidelines with the app targeted for launch during 2022. (association press release)

************************************

BRAKKE CONSULTING VIEWPOINT

Many of our readers may be too young to remember going to a theater to watch a movie that had an intermission. During intermission, you could buy more popcorn, reflect on the first half of the movie and try to guess how things are going to play out for the second half of the movie. I feel like that is where we are with the movie “Growth in Animal Health for 2021” – we are halfway through what looks like a good year.

Let’s start with the biggest actor in the movie: Zoetis – a great first half this year, with revenue up about 25% but forecasting a full year growth of about 13%. Elanco is the complicated actor because of the Bayer acquisition – they reported a 103% growth for the first half this year but keep forecasting 4-5% underlying growth for 2021. Covetrus has had a good first half and expects their global growth to be 5-6% with North America leading the way at 13-14% for the full year. IDEXX sees about 18% full year growth while Heska sees about 30% full year growth in their business.

Other companies have yet to report, so the first half picture is still a bit blurry. The 2nd half of the year will be exciting to watch, maybe the Delta variant will slow things down, maybe 2nd half comparisons will be hard to watch because of the 3rd and 4th quarter performances last year. Stock up on popcorn and come back to watch the ending.

Bob Jones

***********************************

YOUR VIEW

Last week we asked about how likely you thought there will be another mega-merger announced in the next 12 to 18 months. About 60% of you thought that there would be, but we didn’t have enough of the respondents indicating who they thought would be acquired to start any rumors.

This week

The Delta variant of the SARS-CoV-2 virus has been making headlines and has caused companies and government agencies take decisions about mask wearing, mandating vaccinations and returning to the office. Let’s see what impact you think the Delta variant will have on the veterinary industry.

I believe the Delta will have the following impact on the veterinary industry: