***********************************

Brakke Consulting’s

Animal Health News & Notes for August 7, 2020

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Earnings News

Bayer

Boehringer Ingelheim

Central Garden & Pet

Freshpet

Heska

Hill’s

IDEXX

Kindred Biosciences

Krka

Merck

MWI

PetIQ

Pilgrim’s Pride

Spectrum Brands Holdings

Trupanion

Tyson Foods

Zoetis

Other News

American Animal Hospital Association

Ardent Animal Health

Armor Animal Health

Bayer (Elanco)

Bayer (Drontal)

Compassion-First Pet Hospitals

Cronus Pharma Specialties

Elanco

Gnubiotics Sciences

IdentiGEN

MediVet Biologics

Merck

Patterson

Roslin Technologies

Vetoquinol

************************************

REGULATORY WORKSHOP

Animal Health Regulatory 101: An Introductory Course on the Regulatory Aspects of Animal Drug and Vaccine Development

PRESENTED BY KANSAS STATE UNIVERSITY OLATHE

August 26 & 27, 2020 (on-site and remote attendance options available)

Kansas State University Olathe is hosting a two-day workshop on August 26 & 27, 2020 that will provide attendees with the regulatory acumen necessary to make smarter business decisions in management and leadership in the animal health industry. This program provides an overview of essential regulatory guidelines, terminology, concepts and applications in the day to day animal health business.

Registration for this information-packed two-day workshop is $1,500 per person. For more information or to register, click here.

************************************

COMPANY EARNINGS RELEASES

- Zoetis reported its financial results for the second quarter of 2020. Revenue was $1.53 billion for the second quarter of 2020, flat compared with the second quarter of 2019 (+4% on an operational basis, foreign currency adjusted). Net income was $377 million, an increase of 2% on a reported basis. Revenue in the US segment was $823 million, an increase of 6% compared with the second quarter of 2019. (company press release)

- Merck announced financial results for the second quarter of 2020. Animal Health revenues were $1.101 billion, a decline of 2% from the second quarter of 2019. Excluding the unfavorable effect from foreign exchange, Animal Health sales grew 3%. (company press release)

- Boehringer Ingelheim reported results for the first half of 2020. Animal Health’s first-half revenues were EUR 2.2 billion ($2.6 billion), an increase of 5% year-on-year (+4% currency-adjusted). (IHS Markit Connect0

- Bayer AG reported results for the second quarter of 2020. Animal Health reported second-quarter revenues of EUR 488 million ($576 million), an increase of 7.5% year-on-year. The animal health business reported EBITDA before special items of EUR 153 million ($180 million), up by around 18% on the second quarter of 2019. (IHS Markit Connect)

- IDEXX Laboratories announced results for the second quarter of 2020. Revenues were $638 million, an increase of 3% compared to the prior-year quarter. Net income was $149 million, an increase of 19%. Companion Animal Group revenue was $566 million, an increase of 3%; group income from operations was $168 million, up 19%. (company press release)

- AmerisourceBergen reported results for its fiscal third quarter. MWI Animal Health‘s sales were impacted by the effects of COVID-19 and were $1.01 billion during the quarter, a 1% decline compared to the prior-year period. (IHS Markit Connect)

- Heska Corporation reported financial results for its second quarter ended June 30, 2020. Consolidated revenue was $45.7 million, an increase of 62% year-over-year, due largely to the acquisition of scil animal care. North America quarterly sales of $29.0 million rose 10% compared to the second quarter of 2019. Net loss attributable to Heska was $(6.4) million. (GJsentinel.com)

- PetIQ, Inc. reported financial results for the three and six months ended June 30, 2020. Net sales were $267 million, an increase of 21%, despite Services segment closures related to COVID-19. Product segment net sales were $264 million, an increase of 36%; Services Segment net revenues were $2.7 million compared to $26.0 million for the same period last year. Net loss was $(2.0) million compared to net income of $5.9 million in the prior year period. As of August 6, the Company has re-opened 60% of its wellness centers and has piloted and started to re-open community clinics. (company press release)

- Krka reported results for the first half of 2020. The company posted turnover of EUR 38.7 million ($43.7 million), an 8% increase compared to the same period last year. (IHS Markit Connect)

- Kindred Biosciences, Inc. announced financial results for the second quarter of 2020. Net revenue was $39.6 million, compared with $1.2 million for the same period of 2019. The increase in revenue was primarily due to $38.7 million from the sale of Mirataz to Dechra Pharmaceuticals. The company recorded contract manufacturing revenue of $546,000 from a partnership agreement signed on May 20, 2020. Net income was $24.0 million, as compared to a net loss of $(14.3) million for the same period in 2019. (company website)

- Colgate-Palmolive Company reported results for second quarter 2020. Net sales for Hill’s Pet Nutrition were $672 million, an increase of 10% compared to the same period in 2019. Operating profit for the segment was $191 million, a 14% increase compared to the prior-year quarter. (company press release)

- Freshpet, Inc. reported financial results for the second quarter of 2020. Net sales were $80 million, an increase of 33% compared to the prior-year quarter. Net Income was $0.2 million, compared with prior year net loss of $(5.7) million. (Globenewswire)

- Central Garden & Pet Company announced record financial results for its fiscal 2020 third quarter ended June 27, 2020. Third quarter net sales for the Pet segment rose 18% to $413 million compared to the same period a year ago, aided by the Company’s C&S acquisition. Organic Pet sales increased by 15%. (company press release)

- Spectrum Brands Holdings, Inc. reported results from continuing operations for the third quarter of fiscal 2020 ended June 28, 2020. Global Pet Care net sales were $241.5 million, an increase of 9% over the prior-year quarter. (company website)

- Trupanion, Inc. announced financial results for the second quarter of 2020. Total revenue was $118 million, an increase of 28% compared to the second quarter of 2019. Total enrolled pets (including pets from our other business segment) was 744,727 at June 30, 2020, an increase of 29%. Net income was $1.4 million compared to a net loss of $(1.9) million in the second quarter of 2019. (company press release)

- Pilgrim’s Pride reported financial results for its second quarter ended June 28, 2020. Net sales during the quarter were $2.82 billion, down from $2.84 billion in the second quarter of 2019. Net loss was $(6.0) million, compared with a profit of $170.1 million during the same period last year. (Feedstuffs)

- Tyson Foods reported results for its fiscal third quarter ended. Net sales were $10.0 billion, a decline of 8% from the prior-year period. Net income was $527 million, down from $676 million in the third quarter of 2019. The company incurred direct incremental expenses related to COVID-19 totaling approximately $340 million. (company website)

************************************

COMPANY NEWS RELEASES

- Elanco Animal Health Incorporated announced it has closed the acquisition of Bayer Animal Health. Upon close, Bayer AG received $5.17 billion in cash, and approximately 72.9 million shares of Elanco Animal Health common stock, valued at $6.89 billion. Elanco has completed the required anti-trust divestures that had been previously announced; the divested products had 2019 revenue in the range of $120 million to $140 million. (company press release)

- Merck Animal Health announced it completed the acquisition of IdentiGEN, a leader in DNA-based animal traceability solutions for Livestock and Aquaculture from MML Growth Capital Partners Ireland. Financial terms were not disclosed. (company press release

- Patterson Veterinary announced it has enhanced the mobile application for its NaVetor veterinary practice management system. Practitioners now have the ability to complete most client-facing tasks from their phone or tablet. (company press release)

- The FDA announced it has approved Cronus Pharma Specialties‘ generic carprofen chewable tablets for dogs. (FDA)

- MediVet Biologics announced it is re-launching as Ardent Animal Health. The new Ardent Animal Health will build on its base of innovative regenerative cell therapies for osteoarthritis and cancer. (Bezinga.com)

- Compassion-First Pet Hospitals announced that Long Island Veterinary Specialists (LIVS), an AAHA accredited referral and emergency hospital located in Plainview, N.Y., has joined Compassion-First as its forty-third hospital. (company press release)

- Armor Animal Health announced that they will be hosting a 2020 Virtual World Dairy Expo Event. The event will offer product demonstrations, introductions to our team members, virtual farm tours, contests, giveaways and more September 29 – October 3. (company press release)

- The American Animal Hospital Association announced the appointment of Garth Jordan as the association’s next CEO, effective August 31. Jordan most recently served as senior vice president and chief strategy officer for the Healthcare Financial Management Association. (Vet-Advantage)

- UK Vetoquinol announced it has acquired the Profender and Drontal pet dewormers from Bayer Animal Health in the UK and Ireland. Financial terms were not disclosed. (Petbusinessworld.co.uk)

- UK Roslin Technologies announced it has licensed monoclonal antibodies from the UK’s Immunological Toolbox project. The antibodies, which were developed by scientists at the Roslin Institute, will underpin research aimed at understanding innate immune responses in poultry and pigs. (IHS Markit Connect)

- SWITZERLAND Gnubiotics Sciences announced it has raised CHF2.6 million ($2.9 million) in a series A1 funding round. The money will accelerate the commercialization activities of Gnubiotics’ lead candidate, AMObiome, an animal milk oligosaccharide biosimilar designed as a nutritional support for microbiome diversity and life-long gut health of animals. (IHS Markit Connect)

***********************************

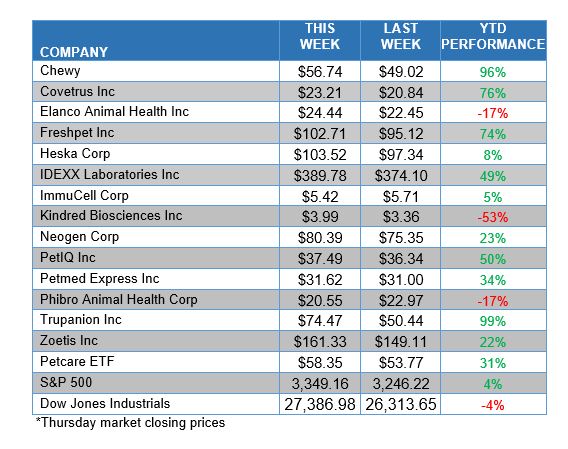

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

ANIMAL HEALTH NEWS

- US – FDA DRUG FEES The FDA announced the fiscal year (FY) 2021 fee rates and payment procedures for animal drugs subject to user fees under the Animal Drug User Fee Amendments of 2018 (ADUFA IV) and Animal Generic Drug User Fee Amendments of 2018 (AGDUFA III). For more information, click here. (FDA)

- US – CATTLE IDENTIFICATION The USDA’s Animal and Plant Health Inspection Service is seeking public comment on a proposal where APHIS would only approve Radio Frequency Identification as the official ear tag for use in interstate movement of cattle that are required to be identified by the traceability regulations. A transition to RFID tags would support APHIS’ ongoing efforts to increase animal disease traceability by more accurately and rapidly allowing animal health officials to know where affected and at-risk animals are located. Public comments will be accepted through Oct. 5 by clicking here. (Farmanddairy.com)

- US – ANIMAL DIAGNOSTICS The USDA’s Animal & Plant Health Inspection Service (APHIS) announced the availability of a “sources sought notice” that will be posted for 30 days to gather information from interested diagnostics manufacturers on their ability to supply test kits for three major livestock diseases: foot and mouth disease (FMD), African swine fever (ASF) and classical swine fever (CSF). The sources sought notice is available through sam.gov. Interested manufacturers should respond by Sept. 3, 2020. (Feedstuffs)

************************************

BRAKKE CONSULTING VIEWPOINT

Ever read a book that was written so well that you purposely slowed down to just to make sure that you didn’t miss anything? That is how I felt reading this week’s News & Notes – had to slow down in case I missed something. There is a lot to read and think about in here.

Obviously, this was a big week for companies to report 2Q results. The weakening US dollar had a financial impact, but correcting for currency, the results showed the resilience of the animal health business. We’ve heard talk about a V-shaped recovery in the animal health segment, maybe we’re seeing it. We’ll have more on AH company 1H performance next week.

And it was a big week for Elanco, finally closing on Bayer’s Animal Health business. The combined revenues of the top four animal health companies are now well over 60% of the total global animal health sales.

Another interesting mention this week is that FDA’s FY 2021 fees have been set – and the increase for new animal drugs is a whopper. Next year, companies will have to pay $574,810 when they submit an new animal drug application to the CVM. This year, it is $440,446. For generic drug applications, the FY 2021 fees are $513,423, up from $493,897 this year. Yes, I had to reread that a few times.

Bob Jones

***********************************

YOUR VIEW

Last week we asked about your summer vacation. About 20% are working to hard and had no summer vacation plans, while about 40% cancelled their plans this year. Over 25% drove somewhere for a vacation and the balance either flew somewhere or had a “staycation” at home. No “V-shaped” recovery in the travel industry.

This week let’s see what you think about the FDA’s fees for animal drug applications. Do you think that the FDA’s fee structure has an impact on innovation in animal health?

If you feel strongly enough about this topic, email me at rwjones@brakkeconsulting.com – would appreciate hearing from you.