***********************************

Brakke Consulting’s

Animal Health News & Notes for February 14, 2020

Copyright © Brakke Consulting

Editor: Lynn Fondon DVM MBA

************************************

IN THE NEWS:

Brakke Consulting News

2020 Industry Overview at WVC – register today!

Earnings News

Hester Biosciences

MWI Animal Health

Nestlé

Ouro Fino Saúde Animal

Tyson Foods

Zoetis

Other News

Animal Supply Company

Bayer

Better Choice Company

cbdMD

Elanco

eTailPet

Ethos Diagnostic Science

GALVmed

Lemonade

Merck

Mountaire Farms

National Veterinary Care

Vetoquinol SA

Zoetis

Zomedica

***********************************

YOUR VIEW

Thanks to everyone that responded to our poll last week. The question was, “Which home delivery service provider would you predict gets the highest markets from veterinarians?” The answer: Of the three companies, MyVetStore earned the highest Net Promoter Score in Brakke’s new study, Pet Health Products: Changing Channels. Only 21% of you had the right answer. Hmmm. Always better to have data.

This week’s poll question:

Plant-based protein offerings made a grand entrance on several fast food restaurant menus and traditional grocery store shelves in 2019.

Have you eaten an Impossible Whopper or other plant-based meat entrée in the last year?

***********************************

The 2020 Brakke Industry Overview

Information to keep you ahead of the pack

Register today for early order discount!

Presented at WVC: February 18, 2020, 2-4 pm, Four Seasons Hotel, Acacia Ballroom

What do industry consolidation, CBD and African Swine Fever have in common? They are all important topics covered in Brakke Consulting’s annual Industry Overview presented at VMX and WVC in early 2020.

2019 was an especially newsy year, and many events have long-range implications for the animal health industry. Key topics and presenters include:

- Industry performance and a special analysis of the public companies in animal health (Dr. Bob Jones)

- Vet practice consolidation, CBD, monoclonal antibodies and other new companion animal technologies (John Volk)

- Disruptive technologies and the changing landscape of the diagnostics industry (Dr. Mike McGinley)

- African Swine fever, plant-based meat and milk products and their impact on protein and animal health product demand (Dr. Cary Christensen)

This information-packed 2-hour session will be especially valuable for executive leadership, sales and marketing, strategy and finance managers.

To register, sign up today on our website by clicking here. Or email Amanda McDavid amcdavid@brakkeconsulting.com or call her at 336-396-3916. Pre-registration cost for WVC is $400; there are discounts for multiple attendees from the same company. We look forward to seeing you there!

************************************

COMPANY EARNINGS RELEASES

- Zoetis reported its financial results for the full year 2019. The company reported revenue of $6.3 billion, an increase of 7% compared with full year 2018. On an operational basis, revenue for full year 2019 increased 10%, excluding the impact of foreign exchange. Net income for full year 2019 was $1.5 billion, an increase of 5%. Companion animal revenue represented 50.2% of revenues, exceeding livestock revenues for the first time. (company press release)

- Nestlé reported full-year results for 2019. Petcare sales were CHF 13.6 billion ($14.0 billion), an increase of 6% compared to 2018 (organic growth of 7%). (company website)

- AmerisourceBergen reported financial results for its fiscal 2020 first quarter ended December 31, 2019. MWI Animal Health sales were $1.03 billion, a year-on-year improvement of around 8%. (Animal Pharm)

- Ouro Fino Saúde Animal reported results for the full year 2019. Turnover was R$620 million ($143 million), an increase of 5% year-over-year. Adjusted EBITDA for 2019 was R$107.2 million ($24.7 million), a decline of 19%. (Animal Pharm)

- Hester Biosciences reported results for its third quarter of fiscal 2020. Sales reached INR434 million ($6.1 million), a 4% improvement in revenues. Its animal healthcare business posted a 40% upturn in revenues to INR165.5 million ($2.3 million). (Animal Pharm)

- Tyson Foods reported its 2020 first-quarter results. Net income rose to $557 million versus $551 million a year earlier. Sales volume decreased in the Beef segment, but increased in the Pork and Chicken segments of the business. (Feedstuffs)

************************************

COMPANY NEWS RELEASES

- Zoetis announced the acquisition of Ethos Diagnostic Science, a veterinary reference lab business. Ethos Diagnostic Science is a business unit of Ethos Veterinary Health and has laboratory locations in Boston, Denver and San Diego. Financial terms were not disclosed. (company press release)

- Merck Animal Health announce the launch of ShutOut (bismuth subnitrate), a sterile, antibiotic-free teat sealant for the prevention of new intramammary infections throughout a dairy cow’s dry period. (hoards.com)

- Elanco Animal Health announced that it has signed an agreement to divest the European Economic Area and UK rights to the Drontal and Profender product families from Bayer AG’s animal health business, to Vetoquinol SA for $140 million in an all-cash deal, subject to customary post-closing adjustments. (company press release)

- Zomedica Pharmaceuticals announced that the Company has filed a U.S. patent application covering compositions and methods for five fecal parasite detection assays for detecting parasitic infections in cats and dogs designed for use with its ZM-020 pathogen detection device. The initial library of pathogens for fecal samples is focused on the identification of hookworms, roundworms, whipworms, coccidia and giardia. The patent application details optimal fecal sample amounts for parasite infection detection. (Yahoo finance)

- Animal Supply Company announced a partnership with eCommerce platform eTailPet. Through eTailPet’s platform and ASC Connect, independent pet retailers can create customized websites that automatically download products from ASC’s online catalogue. Pet parents place their order through the retailer’s site, and orders are automatically routed to ASC for fulfillment. (Pet Business)

- Better Choice Company, Inc. announced the execution of a non-binding letter of intent to form a joint venture with cbdMD, Inc., a leading cannabidiol (CBD) consumer brand. both parties intend to contribute certain CBD animal health related assets with the mutual goal of expanding their respective hemp derived CBD pet brands, in exchange for 50% ownership in the newly formed JV. Initially, the JV will be focused on launching Halo Hemp, powered by cbdMD. (Business Wire)

- GALVmed announced the AgResults FMD Vaccine Challenge Project, an eight-year initiative that intends to bring specifically-tailored FMD vaccines to Africa. The $15.8 million FMD prize competition features a cost-share mechanism through which the buyer of the vaccine will pay a portion of its price, while AgResults will cover the rest of the cost. The competition is open to any animal health companies with experience in the development and commercialization of FMD vaccines. For more information, click here. (Animal Pharm)

- Mountaire Farms announced that it is the first US poultry production company that is One Health Certified by the USDA. One Health Certified is a voluntary animal production program that prioritizes animal health and welfare while addressing important concerns about how food animals are raised. (Delaware First Media)

- Lemonade, a property insurance provider, announced plans to enter the US pet insurance sector in the next few months. (Vet Advantage – Today’s Veterinary Business)

- AUSTRALIA National Veterinary Care announced it has entered into binding agreements to acquire three veterinary clinics in Australia. These acquisitions, plus the recently settled acquisition of an additional veterinary clinic in New Zealand, are expected to deliver aggregate annual revenue of approximately A$7.15 million. (Finnewsnetwork.com.au)

***********************************

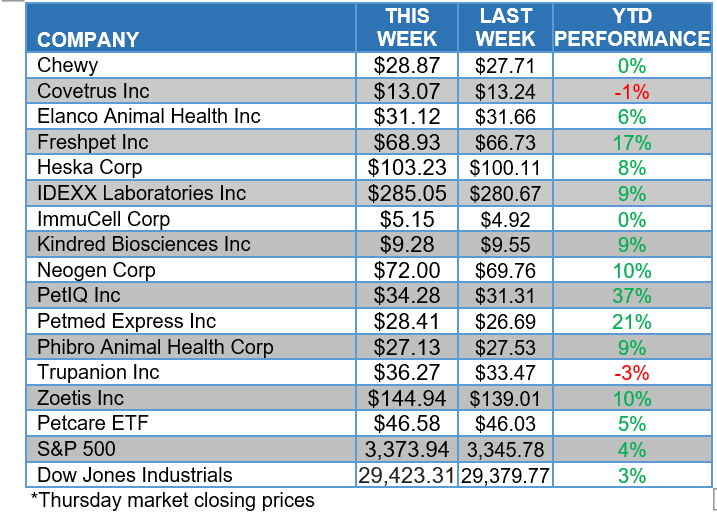

ANIMAL HEALTH STOCK PRICE TRACKER

***********************************

***********************************

ANIMAL HEALTH NEWS

- GREECE – ASF Greece has confirmed its first outbreak of African swine fever (ASF), which has struck a small pig farm near the country’s northeastern border with Bulgaria. Officials have imposed an immediate ban on the movement of pigs out of the affected region, along with controls on the movement of pig products and other items that pose a risk of spreading the disease. (Animal Pharm)

- US – ANTIMICROBIAL RESEARCH The FDA’s Center for Veterinary Medicine (CVM) is announcing a new Fiscal Year 2020 funding opportunity and Request for Applications to support the collection of data on antimicrobial use in dogs and cats. CVM has funded several ongoing studies to collect use data in food-producing animals and believes it is also important to collect data about the use of antimicrobial drugs in dogs and cats and how these use practices might contribute to the development of antimicrobial resistant bacteria. For more information, click here. (FDA)

- US – REGULATORY GUIDANCE The FDA released a draft guidance describing the recommended types of information for stakeholders (industry, academia, other organizations, or an individual) to include in consultations with FDA, before submitting an animal food additive petition (FAP) or a notice concluding that a substance is generally recognized as safe (GRAS) for its intended use in animal food to the agency. For more information, click here. (FDA)

- US – ANTIBIOTIC USE Agri Stats Inc. has reported that the company’s data showed 53% of broiler birds in the US were raised according to a no antibiotics ever (NAE) – including no ionophores or coccidiostats – growing program in 2019. In 2013, only 3% of the flock was raised NAE. (Wattagnet.com)

- WORLD – FEED PRODUCTION According to a survey conducted by Alltech, global feed production declined by 1.07% to 1.126 billion metric tons in 2019, the first drop in nine years. The firm’s latest worldwide feed survey attributed the fall in output to African swine fever (ASF) and the decline of pig feed in Asia Pacific. Data from the survey was accumulated from 145 countries and nearly 30,000 feed mills. (Feedstuffs)

- WORLD – CORONAVIRUS The World Small Animal Veterinary Association (WSAVA) has prepared an advisory document offering guidance and a series of Frequently Asked Questions to help its members when talking with pet owners concerned about the risk of infection with the new coronavirus (2019 n-CoV), following the outbreak in China. It also calls on veterinarians to urge owners not to panic because it is highly unlikely that they could contract 2019 n-CoV from their dog or cat, or that their companion animal could transmit the virus to people or other animals. To read the guidance, click here. (association press release)

************************************

BRAKKE CONSULTING VIEWPOINT

While attending the National Cattlemen’s Beef Association Convention last week, I was impressed with just how far technology has advanced in documenting, monitoring and diagnosing animal management situations. Clever engineering and sophisticated artificial intelligence are converting animal movement, sound and video into useable information. It is no longer in the future; it is now. This information could be animal drug sparing, if not drug replacing in many situations. The technology is transformative and several traditional animal health companies have invested.

This trajectory reminds me of how the photographic film industry, a once large and profitable way to sell plastic and chemicals, transformed into a digital business. Yes, Kodak and Fuji still manufacture film, but Kodak’s failure to acknowledge this transformation was a factor leading to its decline.

Is the food animal segment of animal health to become predominately a technology industry? Will drug administration to livestock become tied to electronic justification and documentation of use? Can artificial intelligence significantly reduce health risk and consequences more effectively than farm managers and veterinarians? If so, will animal health own this “precision livestock” segment and its artificial intelligence, or will it become a new and separate specialty electronic equipment and consulting business? These are all questions worthy of some consideration.

I can’t answer these questions because what intelligence I have is not artificial; it is the old-fashioned kind.

Cary Christensen